From real estate to private equity, alternative investments offer diversification but also bring challenges around complexity, access, and risk.

What are Alternative Investments

Alternative investments is a broad umbrella covering private equity, hedge funds, private debt, high-yield debt, real estate, infrastructure, commodities, digital assets, derivatives, and more. While some, like real estate and commodities, have been traded for centuries, the growth of alternatives as a distinct asset class accelerated in the 1980s through legislative changes, technology, and evolving portfolio theory. Some of the newer forms of alternative investments simply take older investment categories and layer them with complex debt, options, and/or derivatives.

The attributes that most distinguishes alternatives as a broader class, and what makes them attractive to portfolio managers ever seeking to diversify client holdings, is that their returns come from exposure to assets with cash flows that are imperfectly correlated to those of bonds and equity.

By 2025, Fidelity Investments reported that global portfolio allocation to alternatives had risen steadily to 10% overall, with institutional investors now allocating around 25% of their portfolios to alternatives. Investors have been drawn in by compelling historical performance and low correlations, but does this mean modern money managers are constructing better portfolios simply by adding alternatives? Let’s examine.

Performance Insights

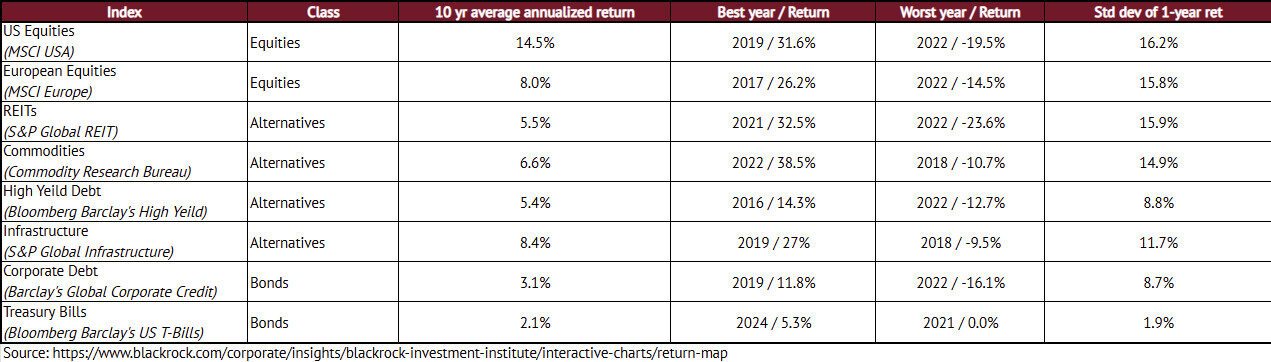

A BlackRock retrospective in 2025 highlights the diversity of performance and volatility within asset classes as measured by index (through September 2025), including some alternatives: (https://www.blackrock.com/corporate/insights/blackrock-investment-institute/interactive-charts/return-map):

These numbers show alternatives are not a monolith: over the reference period REITs and commodities display a high degree of variability (comparable to that of equities), while infrastructure and high-yield debt appear steadier. Also notable is that while in 2022, most of the sampled classes suffered their worst performance year, it was two alternative categories that did not. This should demonstrate that simply allocating to just any alternatives does not necessarily guarantee the enhanced diversification – or returns – investors seek.

Performance benchmarking is also harder and more opaque for many of the alternative classes. Where public stocks and bonds have transparent, real-time pricing and established indices against which to measure performance, alternatives often lack some or all of these features. Private equity often avoids marking certain holdings to market and has no real benchmark with which to gauge relative performance, hedge funds suffer notoriously from survivorship bias in their reporting, and real estate fund valuations – even in publicly-traded vehicles such as REITS – can lag reporting cycles making a

Complexity, Access, and Liquidity

As the investor appetite for alternatives has grown, so too has the complexity of investment products that have emerged, meaning in many cases that only accredited investors need apply as the cost of due diligence and monitoring can put complex products beyond the reach of individual investors. ETFs and other forms of securitization are putting alternatives more within reach of individuals, but not without some intermediary costs. The access barriers for individual investors are evident in the relatively lower share of alternative investments globally (10%) versus the share in institutional portfolios (25%).

Liquidity –the ease with which assets can be bought or sold within an established marketplace – can be another constraint on the use of some alternatives. Many funds (private equity or infrastructure, for example) may lock up capital for periods up to years and some more liquid funds may still only offer periodic (say, quarterly) liquidity windows. A prominent Canadian commercial mortgage investment company just this past month halted redemptions on five of its funds for the first time since the middle of the COVID-19 pandemic, no doubt panicking many investors and reminding others of the liquidity risk inherent in certain types of alternatives. Private credit investments or direct real estate holdings may be ultimately transferable but may require steep discounts to be sold quickly. Still, some alternatives – like REITs or certain derivatives – are highly liquid, so it is important that the liquidity needs of a portfolio be taken into concern when adding certain categories of alternatives.

The Role of Alternatives in Portfolios

Alternatives now occupy an important but complex place in modern investing. They can enhance diversification, offer return potential, and provide unique exposures. Yet, they can carry trade-offs: less transparency, reduced liquidity, and limited access.

The key challenge facing investors may not be whether to hold alternatives, but rather which types could be considered to fit an investor’s objectives, risk tolerance, and liquidity needs. As the landscape continues to evolve, a balanced and disciplined approach will remain the best safeguard against the allure of alternatives becoming an overreach rather than a complement to long-term portfolio success.

Case Studies: Different Investors, Different Alternatives

Alternative investments don’t fit all investors the same way. Their value to a portfolio depends heavily on an individual’s investment horizon, income needs, liquidity preference, and long-term goals. To illustrate, consider two very different hypothetical investors and how alternatives might serve each of them.

Case Study 1: A Younger Investor with High Liquidity Needs

Sophie is 32 and building a successful career. She has a medium-term horizon (five to ten years) and highly values flexibility – she is considering buying a home, but also perhaps shifting careers or starting her own business. Liquidity, therefore, is a priority.

For someone like Sophie, publicly traded alternatives can add diversification without locking up capital. Real Estate Investment Trusts (REITs) provide real estate exposure with daily liquidity, while liquid alternatives that track hedge funds (mutual funds and ETFs) might offer the right balance of liquidity and the diversification benefit of alternatives. Certain private fund structures may also make sense, as they might provide attractive uncorrelated returns but with scheduled redemption opportunities.

On the other hand, long-dated commitments like private equity funds or direct real estate are less suitable. Capital is tied up for years, which could conflict with her need to keep options open.

Case Study 2: A Retired Investor with Stable Income

David is 68 and recently retired with a decent amount of investment experience. Between his pension and other annuity income, his essential needs are covered. Liquidity isn’t a pressing concern, and his main goals are preserving wealth while generating stable, inflation-sensitive income and building wealth to eventually pass along to his family.

For David, illiquid alternatives can perhaps play a central role. He wants to allocate a portion of his portfolio into a privately held, core real estate fund hoping for steady yields from income-producing properties. He’s also thinking about allocating a percentage of his portfolio to holding commodities (for example, the form of gold) as a further diversifier and hedge against inflation.

In contrast, high-risk strategies like venture capital or highly leveraged hedge funds don’t align with his more conservative objectives.

The Bottom Line

Alternatives are not one-size-fits-all. Younger investors may benefit from liquid, flexible options that allow them to adjust as life evolves, while retirees can afford to commit to longer-term strategies that emphasize steady income and capital preservation. Understanding the investor’s profile is as important as understanding the investment itself.