How We Collaborate with Institutions

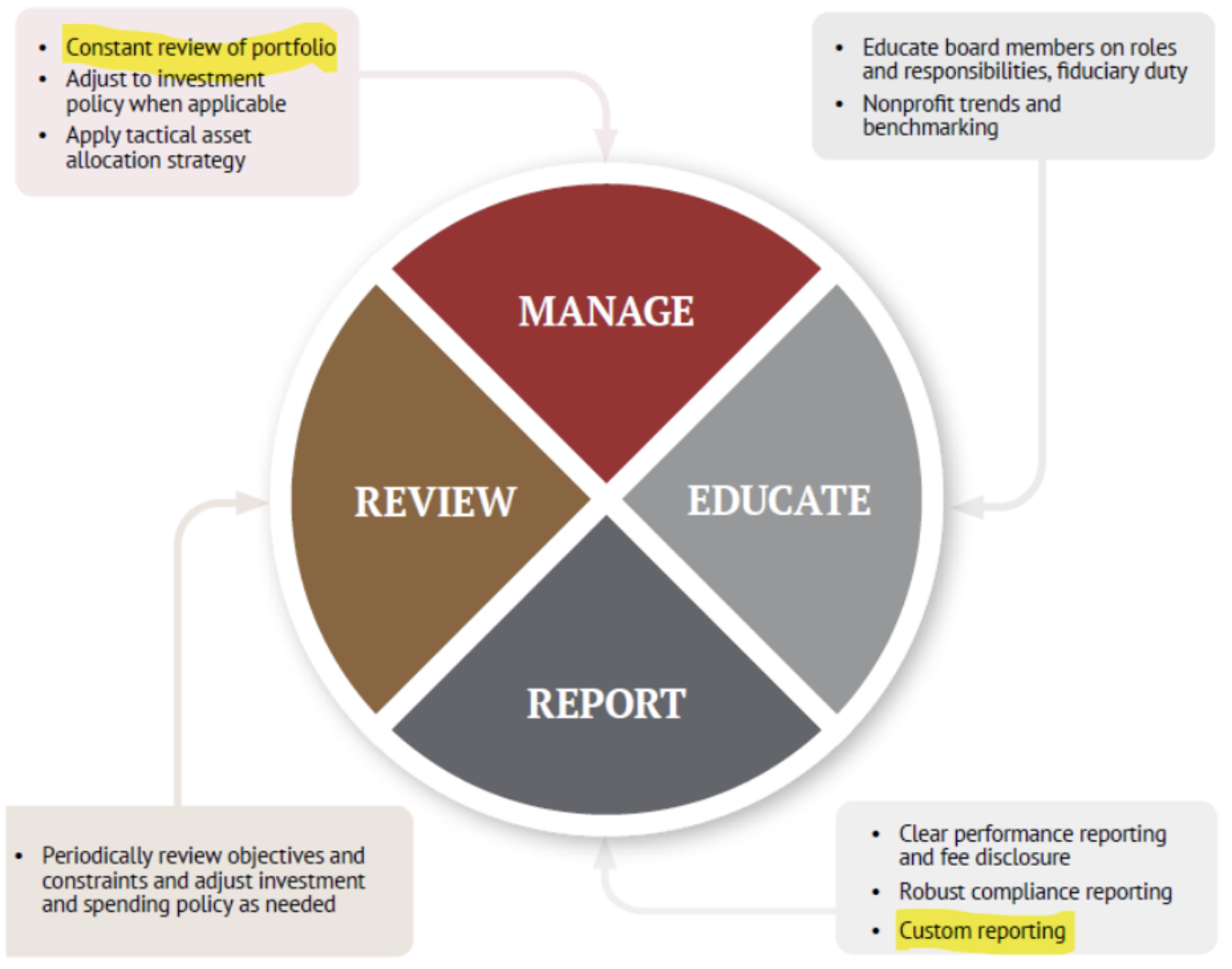

At Louisbourg, our commitment to client education is paramount within our suite of services. We place great emphasis on disseminating insights about financial markets, emerging trends, and best practices adopted by similar institutions in resource management. Our substantial expertise is an invaluable asset for our esteemed clients.

Louisbourg operates as an active manager, engaging in continuous evaluation of strategies aimed at optimizing risk-adjusted returns. This proactive approach is implemented across various asset classes, and it extends to the investment policy statement level when market dynamics or the client’s circumstances change.

To ensure we remain attuned to our clients’ evolving needs, we maintain open lines of communication. This ensures that their objectives and constraints align seamlessly with their investment portfolio. Additionally, we conduct periodic formal reviews to ensure that our investment strategies consistently align with our clients’ objectives.

Our commitment to transparency extends to our comprehensive performance reporting and fee disclosure, eliminating any unexpected charges. Our diligent compliance team ensures that all special criteria specified in the client’s investment policy statement are diligently met. Furthermore, we design tailored compliance reporting tools to streamline our clients’ responsibilities.

Once an institutional investor’s financial framework is established, clients have the flexibility to choose between our in-house suite of Louisbourg Funds or a personalized solution tailored to their specific requirements. From our fixed income solutions to a diverse range of equity strategies and our exclusive Generation Real Estate Fund, Louisbourg provides all the resources your institution needs to construct a well-diversified, risk-adjusted return strategy.

Tailored Solutions for Endowments, Foundations, and Nonprofits

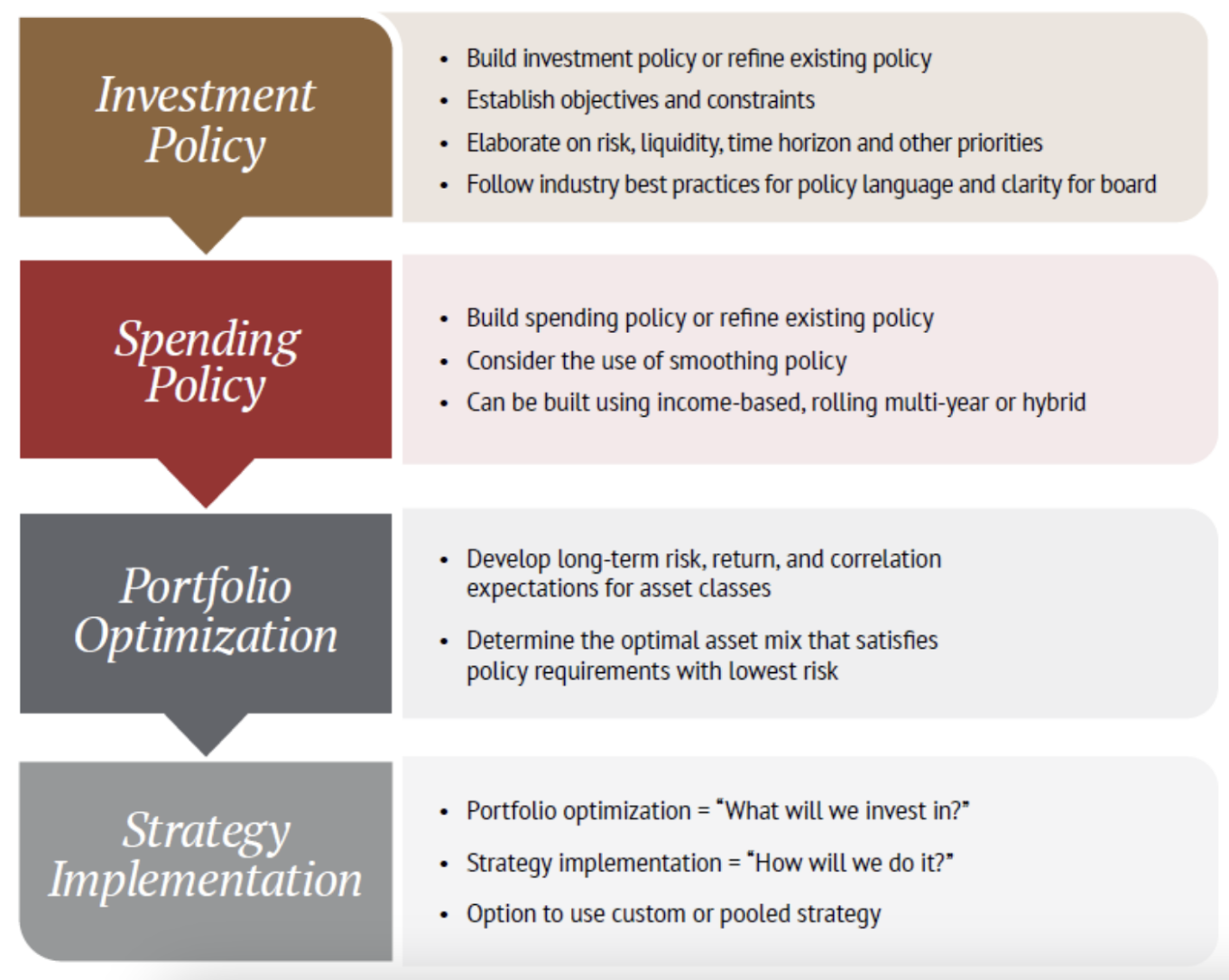

Navigating the intricacies of endowments and foundations, especially the delicate balance between long-term sustainability and immediate philanthropic goals, presents a unique set of challenges. Our consultative solutions offer a strategic roadmap to help endowments and foundations achieve their objectives.

A fundamental component of our approach involves crafting a Strategic Asset Allocation (SAA). This critical step ensures that the investment composition of the overall portfolio aligns seamlessly with the client’s spending requirements and other pertinent constraints. Typically, the development of the SAA is carried out in conjunction with the formulation of the investment and disbursement policy, a process in which our institutional client team plays an integral role in shaping the comprehensive financial landscape.

Equipped with a wealth of data resources, encompassing both proprietary and third-party sources, we collaborate closely with board members. Our role extends beyond mere financial management; we provide comprehensive education, offer insights into peer trends, and facilitate benchmarking against analogous organizations.

- Pensions

- Louisbourg has established enduring partnerships with various types of pension funds, encompassing public and private defined benefit plans, shared risk plans, and defined contribution plans. Our meticulously refined investment process, coupled with advanced risk management techniques, empowers us to consistently deliver exceptional results to our pension clients.

We deploy a combination of balanced and multi-asset strategies, tailoring the investment mix to meet our clients’ specific needs. Our extensive expertise in Liability-Driven Investing (LDI) strategies offers an effective means of managing investments with cash flow requirements. Collaborating with our institutional investment team ensures a straightforward and comprehensible development of the Investment Policy Statement (IPS).

- Insurers

- The management of investment portfolios for insurers entails a myriad of complexities, ranging from tax considerations to regulatory capital requirements and beyond. Since our inception, Louisbourg has been a trusted partner to both life and property and casualty insurers, offering a wealth of experience to our valued insurer clients.

Our adept team possesses a wealth of experience in crafting strategies for Capital-Efficient Investing. This approach involves constructing portfolios that balance yield and capital charges effectively. Moreover, we optimize for tax efficiency to maximize after-tax yields. Sensitivity modeling for regulatory frameworks such as the Minimum Capital Test (MCT) and Life Insurance Capital Adequacy Test (LICAT) is a key facet of our services. This optimization process unfolds in tandem with the development of Investment Policy Statements (IPS) for our insurance clients.

- Family Offices

- High net worth and ultra-high net worth individuals and families place their trust in Louisbourg for highly refined investment solutions. Our offerings include tailor-made tax-efficient strategies and access to our specialized private wealth management team, equipped to handle intricate financial and estate planning matters.

Louisbourg takes pride in maintaining accessibility to our investment team. Our private wealth team collaborates closely with our investment experts to craft the ideal Investment Policy Statement (IPS) for our discerning clients.