When does a great company become a great investment?

As investors, we’re always searching for great companies, but even great companies aren’t always great investments. Whether you’re managing your own portfolio or working with an advisor, understanding the difference between a strong business and a strong investment opportunity is essential. Shopify, one of Canada’s most high-profile tech stories, offers a powerful case study in why the price you pay is a key factor for successful investors.

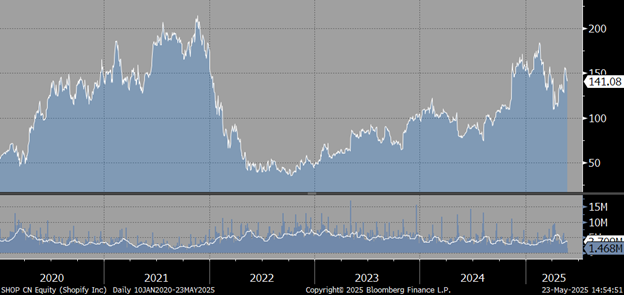

Shopify has been one of the most fascinating investment stories of the past decade. As a company that revolutionized e-commerce by enabling businesses of all sizes to build their own online stores, it experienced a meteoric rise, a steep decline, and a subsequent rebound. This journey offers key lessons for investors on valuation, market sentiment, and long-term opportunity.

The Shopify story: meteoric growth, precipitous decline and strategic rebound

In November 2020, Shopify was formally reviewed by our investment team when it was trading at over $120 per share. At the time, the company was growing rapidly, boosted by the pandemic-driven acceleration of e-commerce. Investors were optimistic about Shopify’s future, given its robust platform, expanding merchant base, and increasing adoption of online shopping.

However, despite the company’s strong fundamentals, one critical concern loomed large: valuation. The stock was trading at an astronomical multiple—over 50 times forward twelve-month revenues (not earnings, but revenues). While the long-term growth prospects were compelling, much of that future potential was already priced in. Simply put, it was expensive. This made it difficult to justify an investment at such a high valuation, despite the many positives surrounding the business.

A key lesson: price matters

One of the most important lessons in investing is that even the best businesses can be poor investments if bought at the wrong price. At that point in its history, Shopify’s risk/reward profile was unattractive. Its strong market position and high growth trajectory were undeniable, but at 50x revenue, the stock had little room for error. This highlights a fundamental investing principle: valuation matters. No matter how promising a company is, overpaying for a stock increases downside risk. When growth slows or external conditions change, excessively valued stocks can experience significant declines.

By November 2021, Shopify had become the largest public company in Canada, accounting for over 7% of the index—surpassing even the Royal Bank of Canada. The market’s enthusiasm for the stock seemed unstoppable. However, macroeconomic factors soon began to create headwinds. Inflation concerns, rising interest rates, and a post-pandemic shift in consumer spending patterns all contributed to a market-wide rotation away from high-growth technology stocks. Shopify, like many other high-multiple tech names, faced intense pressure. From 2021 to 2022, Shopify’s stock began to reflect these challenges. While the company’s business fundamentals remained strong, its relative performance suffered as valuation multiples compressed across the broader market. Shopify’s share price fell more than 75% from its all-time highs to approximately $50 per share. Though revenue continued to grow, the stock’s valuation declined from 50x sales to just 7x.

An excellent company… at the right price

Yet despite the decline, Shopify’s long-term opportunity remained largely intact. The company continued to lead in e-commerce infrastructure, with a growing ecosystem of merchants, integrations, and services. The shift toward digital commerce is a long-term trend, and Shopify was well-positioned to benefit from this transition over the coming decade. In other words, it was still a great company, which became a great investment following the drop in its stock price. That’s when we decided to invest.

In summary, Shopify’s journey underscores the importance of patience, valuation discipline, and a long-term perspective in investing. Great companies can go through volatile periods, especially when expectations become disconnected from fundamentals. For investors, the key is identifying when a great business also becomes a great investment. We waited to strike when Shopify’s valuation became aligned with its long-term potential—an opportunity where both the quality of the business and the price presented a compelling case for investment.